In a remarkable display of resilience and strategic foresight, Apple has emerged from 2025 not only intact but with a firmer hold on the global smartphone market. Finished the year commanding a significant 20% market share, Apple has successfully navigated challenges and capitalized on emerging opportunities to bolster its position.

Apple Leads as Smartphone Market Expands

According to recent industry research, 2025 marked the second consecutive year of growth in smartphone shipments, reflecting a 2% increase year-over-year (YoY). Much of this growth was fueled by consumers opting for premium phones through financing options, robust marketing, and the rapid proliferation of 5G devices in developing markets. Apple, in particular, reaped the rewards of these trends, not only securing the largest market share at 20% but also achieving the highest shipment growth among the top five brands at 10%. Demand remained strong in emerging and mid-sized markets, with the iPhone 17 series gaining notable momentum towards the end of the year, while the iPhone 16 continued to excel in key regions including Japan, India, and Southeast Asia.

Apple's achievements in 2025 can be attributed to its expanding presence and increased demand across emerging markets, underpinned by a diverse product lineup. The late-year momentum of the iPhone 17 series, combined with sustained success of the iPhone 16 in strategic regions, was further enhanced by a surge in upgrades from the COVID-era.

— Varun Mishra, Senior Analyst, January 2026

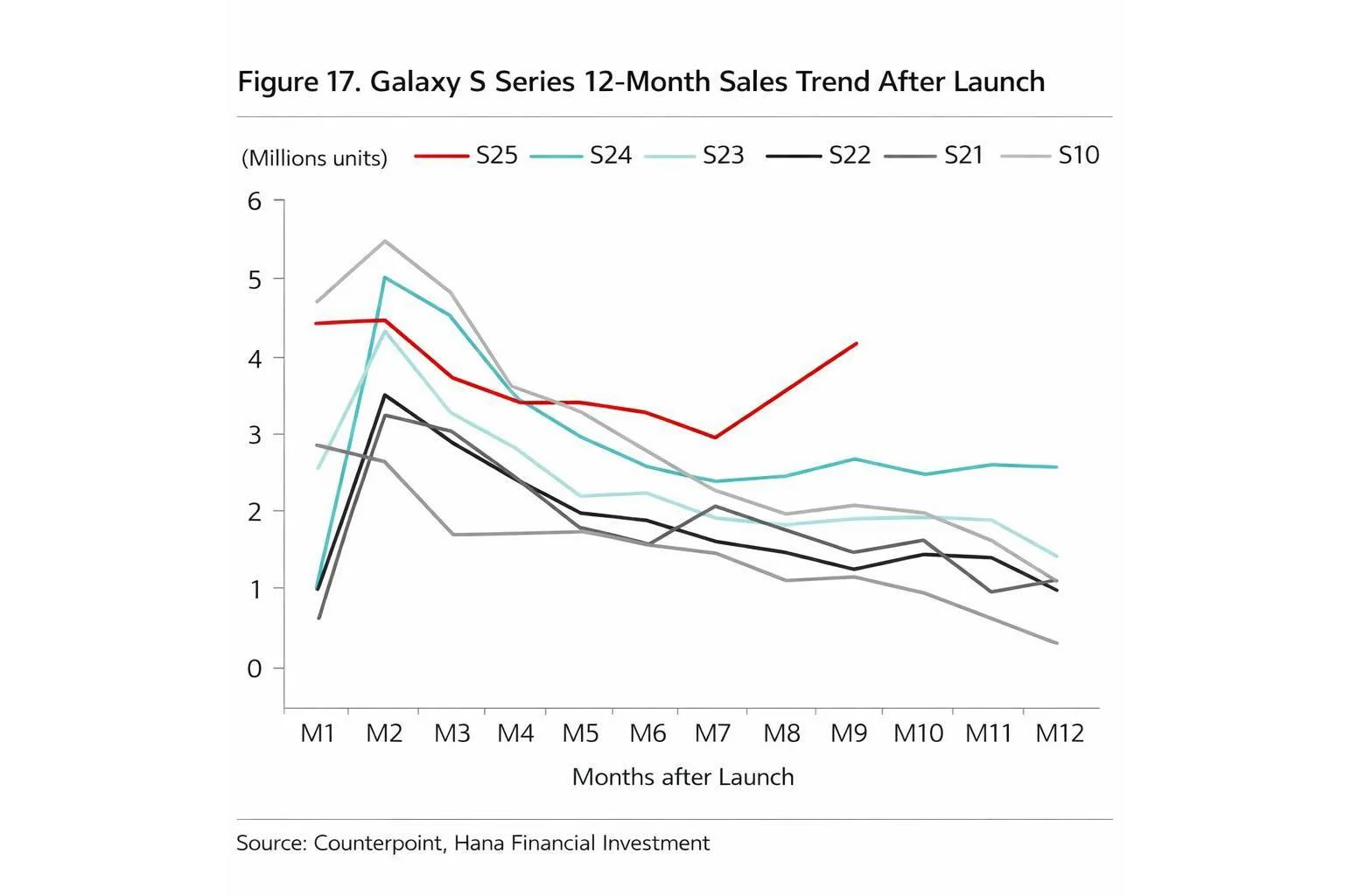

Samsung closely trailed Apple, holding a 19% market share with a 5% YoY growth, bolstered by the popularity of the Galaxy A series, alongside successful launches of premium devices like the Galaxy Fold 7 and Galaxy S25.

Trending Stories

As highlighted in a report by Counterpoint Research, the smartphone market is on an upward trajectory once more. Xiaomi secured the third spot with a 13% market share, bolstered by a blend of flagship and mid-range devices, as well as steady demand in emerging markets. Vivo also saw positive results, posting 3% shipment growth thanks to a premiumization strategy and strong sales in India. Unfortunately, Oppo faced challenges, witnessing a 4% YoY shipment decline due to decreasing demand and fierce competition in Asia-Pacific.

Expectations for 2026

As the landscape shifts, smartphone prices are beginning to rise. Samsung has openly acknowledged that the increasing costs of components are prompting adjustments, including potential price hikes for flagship models like the Galaxy S26. Both Apple and Samsung are anticipated to navigate these pressures better than their competitors, owing to their robust supply chains and focus on premium models. Conversely, Chinese brands that lean more towards budget-friendly devices may feel the weight of these changes more acutely.

Can Anyone Challenge Apple and Samsung's Supremacy?

Recent polling indicates a mix of opinions on whether any competitors can realistically challenge the dominance of Apple and Samsung, with the majority leaning towards the belief that their hold on the market remains strong.

A Promising Future Ahead

Tim Cook has conveyed a positive outlook for Apple's future to investors, a sentiment that appears supported by this recent market research.