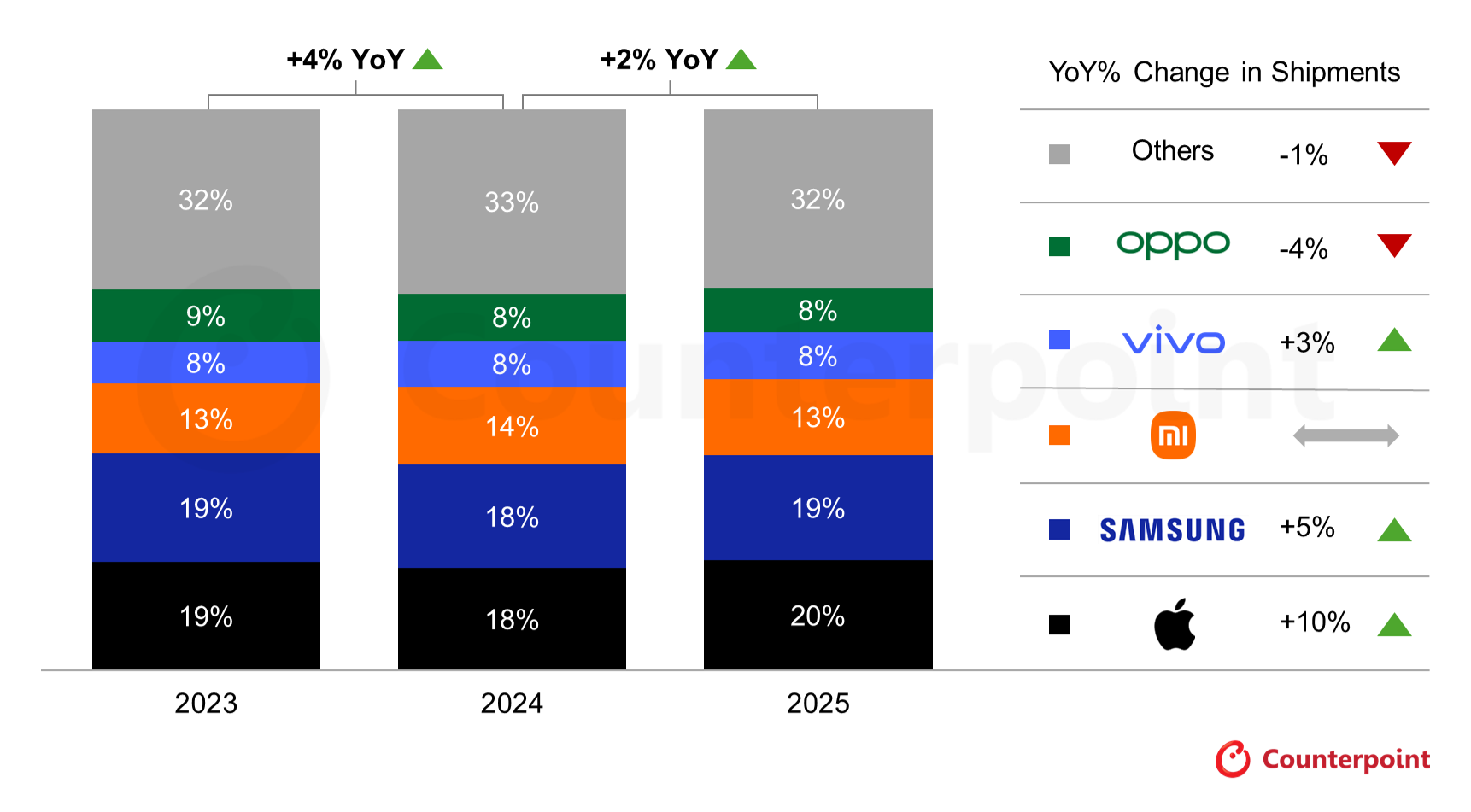

In the final quarter of 2025, smartphone shipments experienced a modest increase of 1%. Throughout the year, global shipments rose by 2%, according to preliminary data from Counterpoint Research. This marks the second consecutive year of growth.

As anticipated, Apple emerged as the leading smartphone manufacturer worldwide, securing a 20% market share—meaning that one in every five smartphones shipped in 2025 bore the Apple logo. Notably, Apple experienced the highest year-on-year shipment growth among the Top 5, with a 10% increase.

The older iPhone 16 fared well in Japan, India, and Southeast Asia, while the new iPhone 17 series saw rising demand. Analysts at Counterpoint attributed this strong sales performance to the lingering effects of the COVID era, which disrupted upgrade cycles and left millions of users ready to upgrade in 2025.

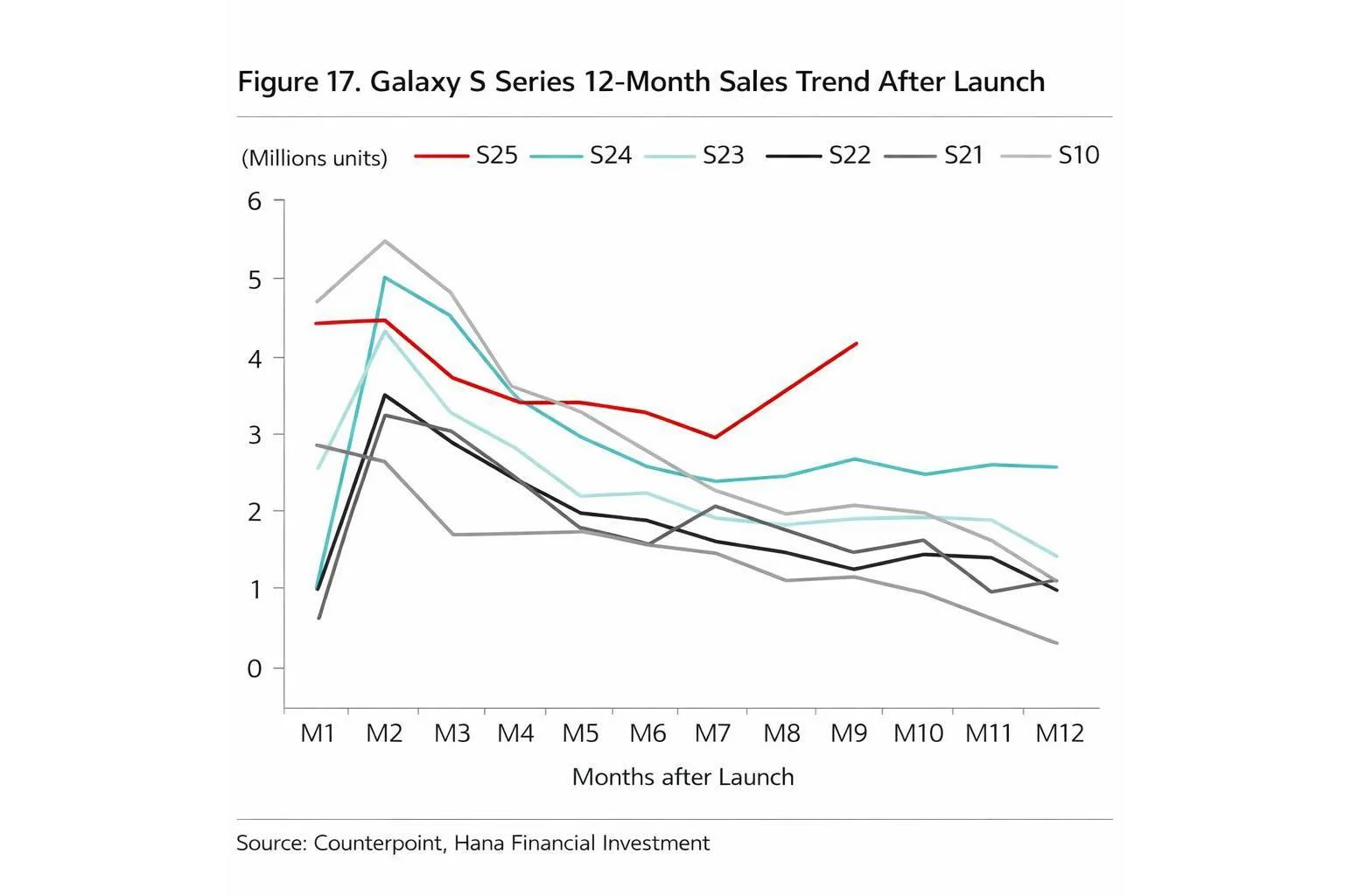

Samsung secured the second spot with a solid 5% growth compared to its competitors in the Top 5. The improved performance of the Galaxy S25 series and Galaxy Z Fold7 contributed to its success in the premium market. Additionally, growing interest in the Galaxy A-series bolstered Samsung's sales in the mid-range segment.

Xiaomi maintained its third position with a steady 13% market share, with South America and Southeast Asia identified as key growth markets.

vivo experienced a 3% growth and overtook Oppo, which saw a drop of 4%. Analysts noted that vivo's strong sales in India were a significant factor in its success, while Oppo faced challenges from heightened competition in China and the Asia-Pacific region.

While not in the Top 5, Counterpoint noted remarkable growth from brands like Nothing and Google, which saw increases of 31% and 25%, respectively, over the full year of 2025.

Looking ahead, potential issues arising from fluctuating memory prices could disrupt the continuous growth trend. Research Director Tarun Pathak stated, “The global smartphone market is set to soften in 2026 amid DRAM/NAND shortages and rising component costs, as chipmakers prioritize AI data centers over smartphones. Price hikes in smartphones have already begun to surface. Against this backdrop, we have revised our forecast for 2026 by reducing shipment estimates by 3%.”

Source