T-Mobile Outshines AT&T: A Deep Dive into Recent Industry Trends

The competition in the wireless industry has intensified over recent quarters, with T-Mobile consistently leading in key metrics. As the industry awaits the upcoming Q4 2025 earnings reports from AT&T, Verizon, and T-Mobile, it becomes clear that AT&T is struggling to keep pace. Recent statistics reveal a troubling trend for AT&T, particularly in customer satisfaction and churn rates, while T-Mobile continues to assert its dominance in both performance and subscriber growth.

AT&T Faces Rising Churn Rates in Q3 2025

As we approach the end of Q4 2025, AT&T's third-quarter results have raised eyebrows. The company reported a postpaid phone churn rate of 0.92%, up 14 basis points from the previous year. AT&T's CEO, John Stankey, acknowledged the fierce competition from T-Mobile and Verizon, mentioning their aggressive strategies in acquiring new customers.

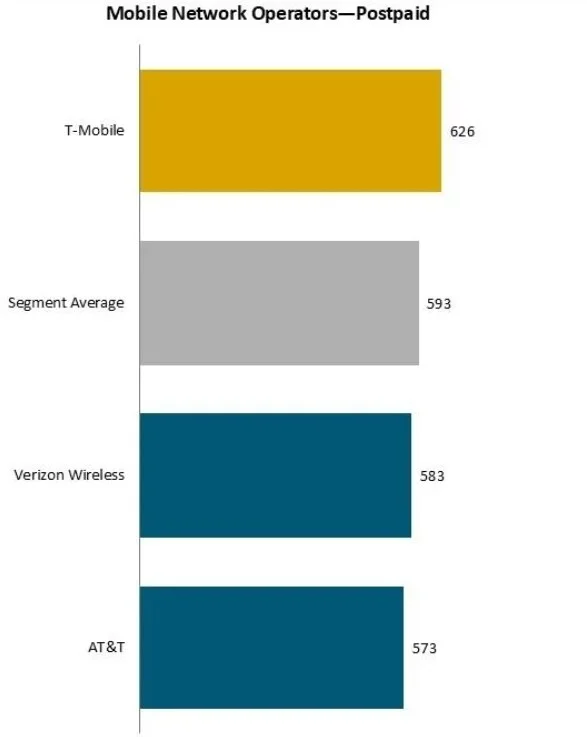

The rising churn also aligns with J.D. Power's recent survey, which ranked AT&T lower in customer satisfaction compared to its rivals. On a scale of 1,000 points, T-Mobile scored the highest with 636, followed by Verizon at 583, while AT&T lagged behind with a score of just 573.

Carl Lepper, J.D. Power's senior director of technology, media, and telecom, highlighted the importance of value and service quality in enhancing customer experiences, as expectations for network performance and service plans continue to rise.

RootMetrics and Mixed Results for AT&T

Despite the challenges, AT&T did receive recognition from RootMetrics, which named it the top carrier in the U.S. for the first half of 2025 due to its consistent performance across the country. However, T-Mobile claimed the title of the fastest wireless provider according to Ookla and Opensignal, citing a significant lead in speed performance thanks to its mid-band spectrum capabilities.

Stock Performance Highlights

In a surprising twist, AT&T’s stock has outperformed both Verizon and T-Mobile over the past year, rising 8.34% to $24.56, despite its operational challenges. In contrast, T-Mobile's stock fell by 8.91%, closing at $199.58, while Verizon saw a modest increase of 0.65% to $40.52.

Analysts Project AT&T's Q4 Earnings

Looking ahead, analysts anticipate that AT&T will report $32.29 billion in revenue for Q4 2025, marking a slight increase of 0.8% year-over-year. However, earnings per share are projected to decline by 13% to 47 cents. Furthermore, the company’s postpaid phone net additions are predicted at approximately 465,000, down 11.5% from the previous year.