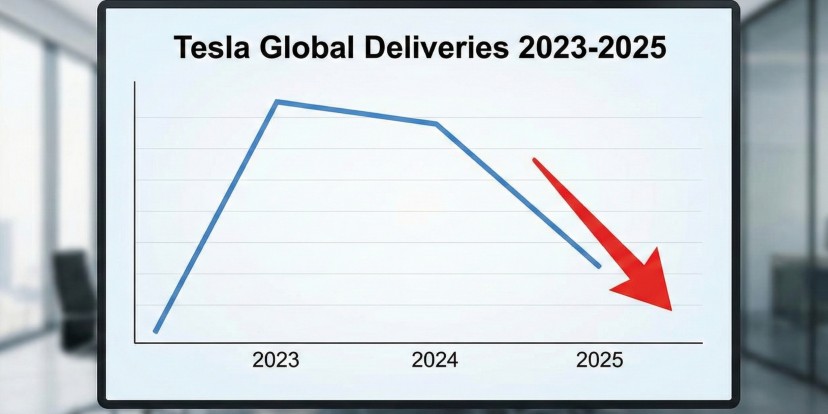

Tesla was once the undisputed leader in the electric vehicle industry. For nearly a decade, the company experienced rapid growth, seemingly invulnerable to competition. However, the latest sales figures for 2025 reveal a different story: for the second consecutive year, Tesla experienced a decline in vehicle deliveries.

This trend is accelerating. In 2023, Tesla's deliveries peaked at 1.81 million electric cars. The following year saw a slight decrease to 1.79 million. Now, with the 2025 figures public, the situation appears even more challenging for the American automaker. Tesla reported delivering a total of 1,636,129 vehicles in 2025, representing a decrease of over 8.5% from the previous year.

The fourth quarter of 2025 was particularly tough for Tesla. Between October and December, the company delivered 418,227 vehicles worldwide. While this figure is substantial, it is 15.61% lower than the same period in 2024 and nearly 16% down from the previous quarter. Market experts had anticipated deliveries of at least 420,399 units. Tesla even released a revised estimate of 422,850, but ultimately fell short of those goals.

Analyzing the specific models, the Model 3 and Model Y remain the top sellers, handling most of the demand. In the last quarter alone, Tesla produced 422,652 of these models and delivered 406,585. For the year, the company manufactured 1,600,767 units of the Model 3 and Model Y, delivering 1,585,279 of them. In contrast, the 'Other Models,' including the pricier Model S, Model X, and the Cybertruck, had limited output, with only 53,900 produced and 50,850 delivered.

Perhaps the most shocking revelation in the report is that Tesla is no longer the global leader in battery electric vehicles (BEVs). That designation now belongs to BYD, which sold an impressive 2,256,714 pure electric cars in 2025, surpassing Tesla's sales by over 600,000 units. While Tesla's sales were declining, BYD's sales surged by nearly 28%. Although BYD also markets plug-in hybrids, their sales dropped to 2,288,709 units. Nevertheless, in the race for pure electric vehicles, the Chinese company has claimed the top spot.

Several factors contribute to Tesla's struggles. In Europe, many consumers are moving away from the brand, with new registrations for Tesla vehicles down by 28% in the first eleven months of 2025. Analysts suggest that this decline may be linked to CEO Elon Musk's controversial political activities, which have reduced the brand's appeal in certain regions.

Conversely, BYD has seen its European sales soar by an astonishing 276% during the same period. In China, competition is intensifying, with Tesla's sales declining by over 7% through November as local manufacturers introduce newer, more affordable electric options.

Tesla's current lineup is also aging. The Model 3 and Model Y are becoming dated, and recent updates have not significantly sparked consumer interest. In a rapidly changing market, buyers often seek the latest technology and innovative designs. As new models are lacking, Tesla has relied on price reductions and incentives, which are starting to wane in regions like the United States.

Amid these challenges, there is a silver lining in Tesla's recent financial report: the company set a new record for its energy storage sector, deploying 14.2 GWh of energy storage in the final quarter. While this achievement is positive, it is unlikely to offset the reduced earnings from car sales, and Tesla is expected to conclude 2025 with diminished revenue and profits compared to the previous year.

Elon Musk has recently articulated a vision for Tesla as an AI company rather than solely an automotive manufacturer, expressing a desire to focus on robotics and autonomous driving technologies. For those who share this vision, the declining car sales may not seem alarming. Nevertheless, the latest figures signal a potential crisis for the company.

Source