The American electric vehicle (EV) market encountered challenges in 2025, witnessing its first sales decline in several years. By the end of the year, approximately 1.28 million units were sold, a 2 percent decrease from 1.3 million in 2024.

This drop can be attributed to several factors, including the conclusion of government tax credits and persistently high prices that remain unaffordable for many consumers. Despite an increase in available models, some buyers chose to postpone their transition to electric vehicles.

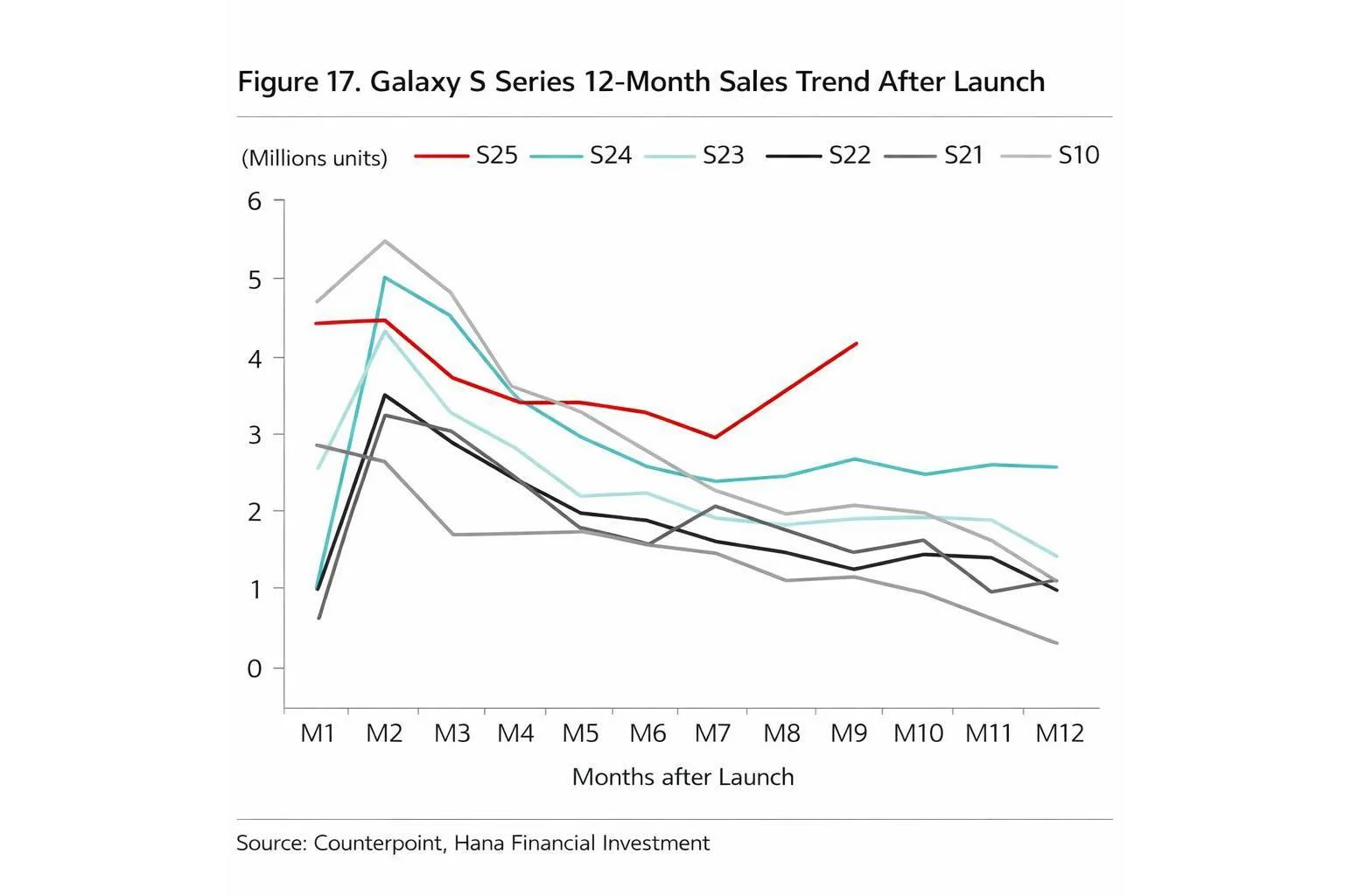

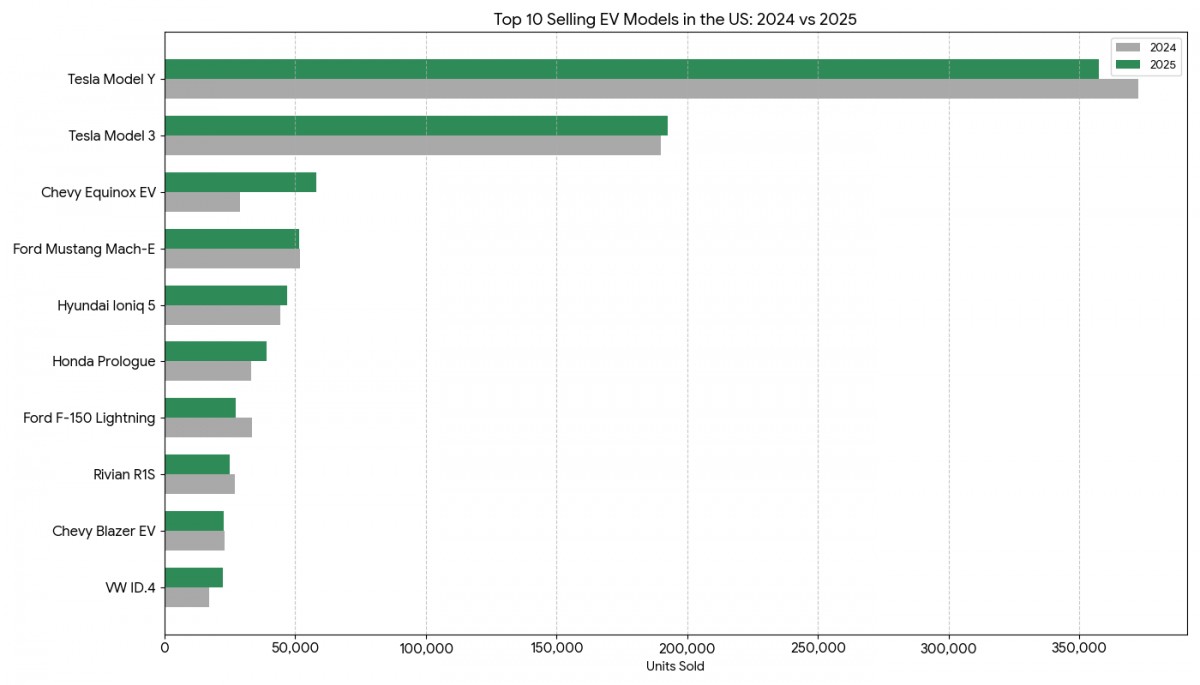

Top 10 US Brands Sales Volume 2024 v 2025 - source: Arena

Top 10 US Brands Sales Volume 2024 v 2025 - source: ArenaTesla maintained its position as the leading brand in the American EV market; however, its dominance is waning. In 2024, nearly half of all electric cars sold in the U.S. bore the Tesla name. By the close of 2025, this share decreased from 48.7 percent to 46.2 percent. The company sold 589,160 vehicles during the year, marking a 7 percent decline compared to the previous year. The Tesla Model Y remains the most popular electric car in the country, with 357,528 units delivered, although its sales also fell by 4 percent.

While Tesla faced challenges, General Motors (GM) experienced remarkable growth, with sales reaching 169,887 units in 2025—a significant 48 percent increase from its 2024 performance. Chevrolet significantly contributed to this success, as the Chevrolet Equinox became a favorite among buyers, with sales doubling to 57,945 units.

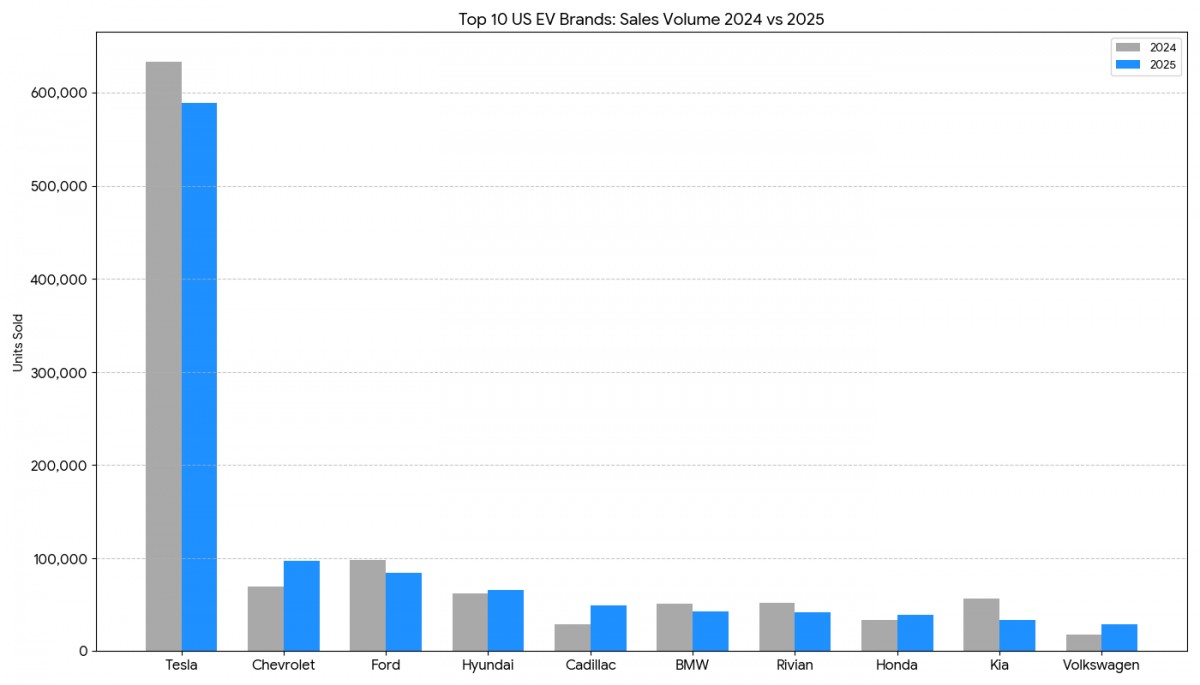

Top 10 Selling Models in the US: 2024 v 2025 - source: Arena

Top 10 Selling Models in the US: 2024 v 2025 - source: ArenaCadillac also saw substantial growth, increasing its sales by over 69 percent to 49,152 vehicles. GM is demonstrating that offering a diverse range of models can appeal to consumers who previously showed little interest in electric cars.

Not all traditional automakers enjoyed similar success. Ford struggled, with sales dropping by over 14 percent to 84,113 units. The Ford F-150 Lightning faced an 18.5 percent decline, resulting in only 27,307 total sales. Other brands like Kia and BMW also recorded lower sales figures, with Kia experiencing a significant downturn of nearly 40 percent. These trends indicate that merely offering an electric vehicle is insufficient; consumers are increasingly seeking specific features and more attractive pricing.

2025 VW ID.4 - source: Volkswagen

2025 VW ID.4 - source: VolkswagenOn the other hand, some international brands identified opportunities within the market. Volkswagen witnessed a sales increase of nearly 57 percent, driven by the success of the ID.4 model, which sold 22,373 units. Honda progressed as well, with its Prologue model selling 39,194 vehicles. Hyundai remained stable, with the Ioniq 5 achieving sales of 47,039 units. These companies are actively competing for customers moving away from Tesla. Although the overall market contracted slightly, competition among brands is intensifying.

The landscape of the U.S. electric car industry is evolving. The explosive growth characteristic of its early years is giving way to a more mature market. With 1.28 million sales, electric vehicles continue to hold a significant position in the American automotive sector. Automakers will need to enhance their efforts in reducing prices and upgrading technology if they aspire to revitalize sales in 2026.

Source