RAM prices have surged significantly in recent months, posing a major challenge for the smartphone industry in the coming years. Analyst firm Counterpoint has updated its 2026 forecast, now projecting a 2.1% contraction in the global smartphone market instead of the previously expected stable shipment levels.

Worryingly, Counterpoint warns that elevated memory prices are likely to persist, potentially increasing by another 40% through mid-2026.

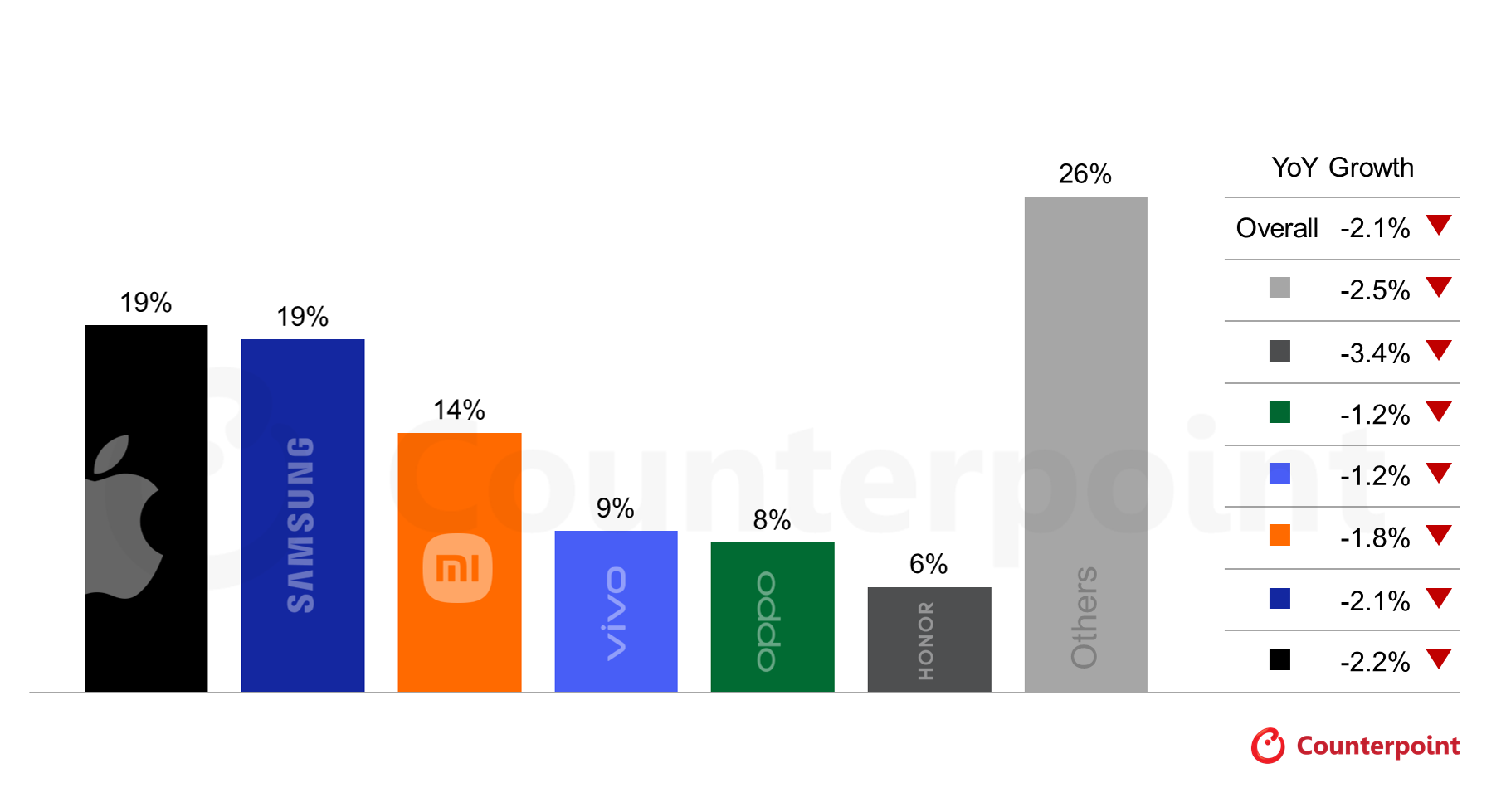

Global Smartphone Market Share and YoY Growth by Key OEM, 2026(E)

Global Smartphone Market Share and YoY Growth by Key OEM, 2026(E)Currently, the Bill of Materials (BoM) for low-end smartphones is approximately 25% higher than at the start of this year. Mid-range and high-end devices are experiencing cost increases of 15% and 10%, respectively. Should the Q2 forecast prove accurate, these costs could rise an additional 8% to 15%.

Counterpoint expects shipment declines across major brands. Oppo and vivo, initially forecasted to grow shipments next year, are now predicted to face declines. Xiaomi and Honor are expected to see steeper drops than initially anticipated.

Leading brands Apple and Samsung will also face challenges but are comparatively better positioned. Senior Analyst Yang Wang notes, “Apple and Samsung are best equipped to navigate the coming quarters. However, smaller players, especially Chinese OEMs, will struggle to balance market share and profit margins as the year progresses.”

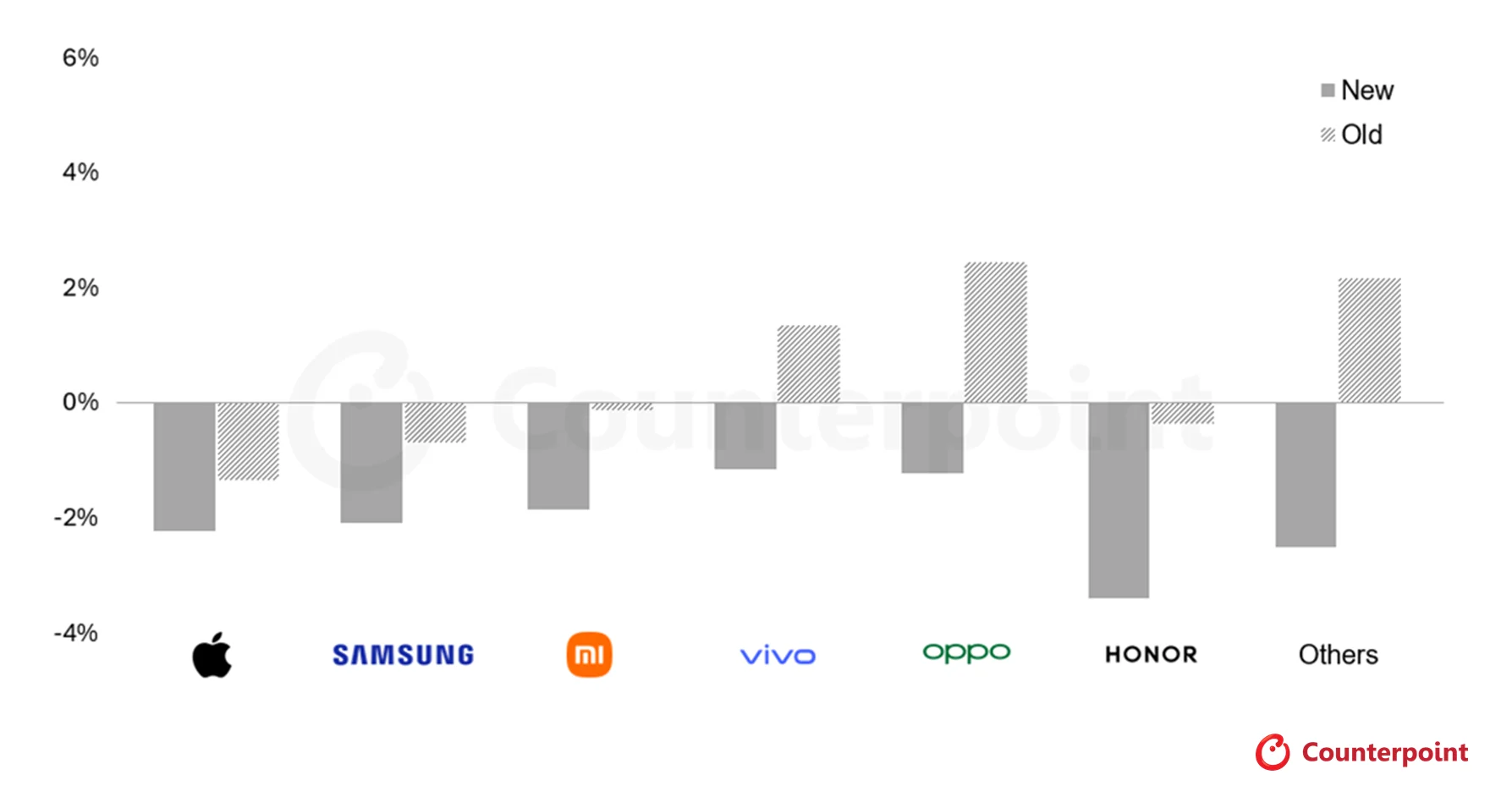

Smartphone Shipment YoY Growth Forecasts and Revisions, 2026

Smartphone Shipment YoY Growth Forecasts and Revisions, 2026In response to rising costs, smartphone manufacturers are already adjusting their product lineups by reducing specifications. Senior Analyst Shenghao Bai explains, “Certain models are seeing downgrades in components such as camera modules, periscope lenses, displays, audio parts, and memory configurations.”

Analysts also warn that the Average Selling Price (ASP) in 2026 will increase more than previously expected, now forecasted at a 6.9% rise instead of the original 3.9%. This suggests brands may steer consumers towards premium models, which are less affected by high RAM costs due to RAM accounting for a smaller portion of their BoM.

Source