The global smartphone market is on track to experience a contraction in 2026, driven largely by escalating memory component costs. This downturn is expected to create challenges not only for industry giants like Apple and Samsung but also for prominent Chinese manufacturers such as Xiaomi, Vivo, Oppo, and Honor. Earlier predictions anticipated stable or growing shipments for these companies, but the latest forecast paints a more difficult picture.

Who Will Bear the Brunt of Market Declines?

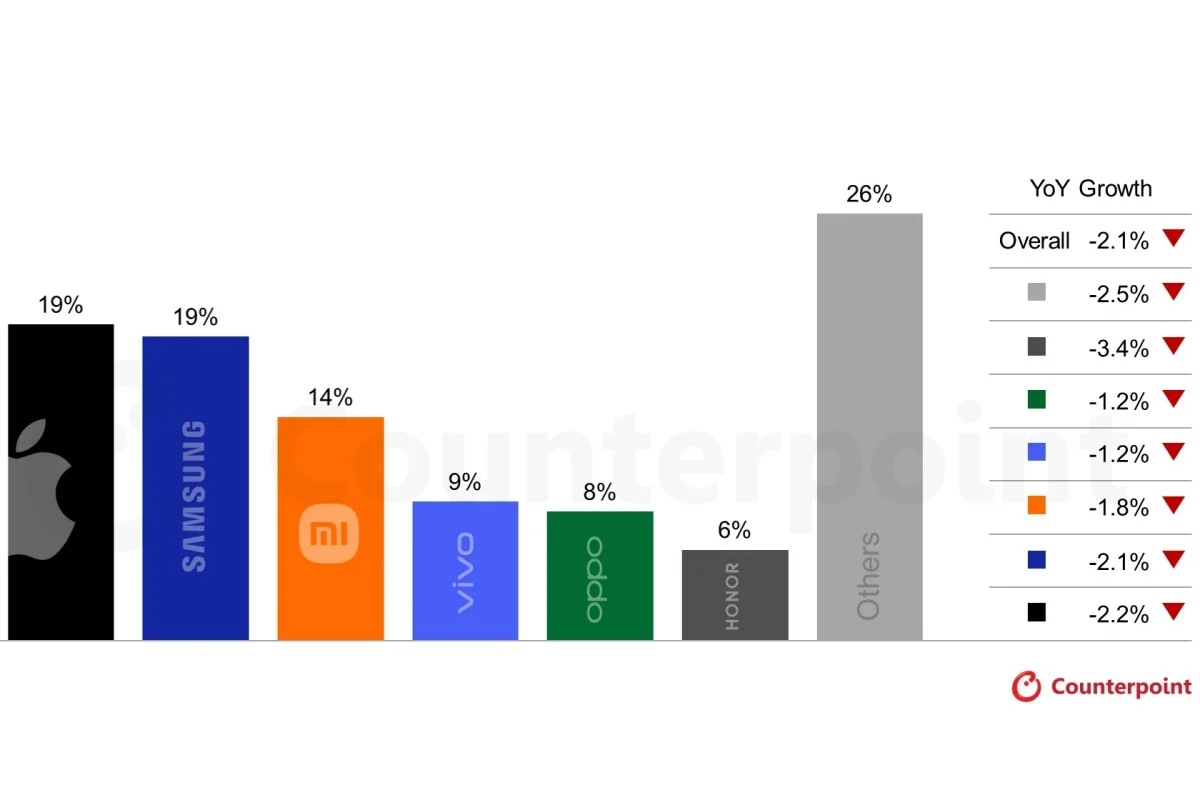

While it’s premature to definitively identify the biggest losers in the market next year, the new estimates from Counterpoint Research indicate a complex and evenly distributed downturn. Apple and Samsung are projected to see shipment declines of 2.2% and 2.1% respectively year-over-year. Even more concerning are the projections for Vivo and Oppo, both expected to face a 1.2% reduction — a disappointing reversal from prior growth expectations.

Xiaomi appears to be faring slightly better, with a predicted shipment drop of 1.8%, though this is a significant increase from earlier forecasts. Despite this, Xiaomi is likely to maintain its position as the third-largest smartphone vendor globally in 2026.

The smartphone market is facing notable headwinds across all major manufacturers.

Another major concern is Honor, which now faces an alarming forecasted drop of 3.4% in sales volume. Meanwhile, the combined “others” segment, holding approximately 26% of the market share, is expected to shrink by 2.5%, contributing further to the projected overall industry decline of about 2% in 2026.

Although these figures suggest widespread difficulties ahead, industry analysts believe Apple and Samsung are currently the best positioned to endure the challenging market conditions over the coming quarters.

Will Consumers Face Higher Prices for New Phones?

With component costs, especially for memory, expected to rise by 10 to 25 percent, many smartphone manufacturers will likely pass some of these expenses on to consumers through higher device prices. However, steep price hikes won’t be sustainable within the more affordable segments, meaning budget smartphones could largely retain their cost-effectiveness. That said, low- to mid-tier devices might see fewer upgrades and improvements as manufacturers prioritize preserving profit margins.

For instance, Motorola's upcoming Moto G Power (2026) model has notable similarities to its predecessor, reflecting a likely industry trend of portfolio trimming to manage production costs and streamline supply chains.

For consumers considering a new smartphone, it might be wise to take advantage of existing discounts while they last, especially during holiday sales, as pricing dynamics and product availability evolve in 2026.

Is There Room for Optimism?

While predicting exact shipment numbers nearly a year in advance is inherently uncertain, the overarching trend of market contraction appears clear. However, Apple and Samsung may mitigate some decline through strategic product launches. For example, Apple's highly anticipated first foldable iPhone could bolster its sales figures, while Samsung’s upcoming Galaxy S26 series must maintain competitive pricing similar to the current Galaxy S25 lineup to sustain demand.

Though these strategies won't completely offset the industry-wide shrinkage, they could soften the impact, resulting in a less severe downturn than some forecasts suggest.